MENA Weekly Summary – January 21-27, 2026

Highlights of the Week

This report reviews notable events in the Middle East and North Africa this week. These include Israel’s recovery of the final deceased hostage from Gaza, the alleged arrival of a sanctioned Russian vessel in eastern Libya’s Tobruk, the latest 15-day ceasefire between the government and Kurdish forces in Syria, strengthening ties between the UAE and India, and the increasing risk of military confrontation between the US and Iran, and the associated ripple escalation risk across the MENA region.

MENA

Current Situation

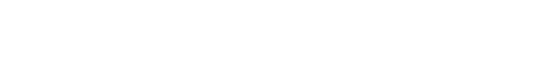

- On January 26, US Central Command (CENTCOM) confirmed that the USS Abraham Lincoln Carrier Strike Group (CSG) has been deployed in its area of responsibility.

- In an interview published on January 26, US President Donald Trump stated that Iran has repeatedly reached out to Washington, saying it “wants to talk.”

Assessments & Forecast: The arrival of USS Abraham Lincoln marks the culmination of a broad US military buildup in the region over the past week. These deployments are notable and reflect the amassing of a range of assets that increase Washington’s strike options. This increases the prospects for military confrontation between the US and Iran. That said, the arrival of the CSG is not necessarily indicative of imminent military action, an assessment lent some credence by President Trump’s remarks raising the possibility of negotiations with Tehran. However, the US would likely table an uncompromising deal aimed at eliciting extensive commitments from Iran on nuclear enrichment, its ballistic missile arsenal, and proxy network. This is based on the assessment that in its weakened position, Iran will show greater flexibility on these core issues. However, as precedent indicates, Iran is unlikely to agree to these demands, which it perceives as fundamental to its deterrent capabilities. Against this backdrop of an increasing risk of military confrontation, Iran-backed regional allies, including Kataib Hezbollah, Hezbollah, and the Houthis have begun to express their willingness to engage in attacks in solidarity with their patron. In a military flare-up scenario, attacks by these actors are more likely to manifest in UAV/limited ballistic missile attacks on US assets in the region, Israel, and/or regional maritime routes, including the Red Sea, Gulf of Aden, and Persian Gulf. This would also risk drawing Israel into the fray and elicit retaliatory Israeli/US strikes on Axis of Resistance strongholds, potentially extending to Lebanon, Iraq, and Yemen. Overall, this underscores the escalation risk across the region.

Source: US CENTCOM

Israel & Palestinian Territories

Current Situation

- On January 22, US Envoy Jared Kushner unveiled the US reconstruction plan for Gaza. He stated that the next step would be “working with Hamas on demilitarization,” and that no investment would be made without security.

- On January 26, Israel recovered the remains of the final deceased hostage in Gaza. This was facilitated by intelligence gained in interrogations of a Palestinian Islamic Jihad (PIJ) detainee.

- In a press conference on January 27, Prime Minister (PM) Benjamin Netanyahu reiterated his narrative that Hamas will disarm “the easy way or the hard way.” He further stated that reconstruction will not begin before disarmament and that Turkish and Qatari forces will not enter Gaza.

Assessments & Forecast: Envoy Kushner’s plan underscores Washington’s intent to advance the ceasefire framework and initiate Gaza’s reconstruction and development process, beginning with Rafah. The return of the final hostage marks the removal of a key obstacle to Jerusalem’s participation in Phase Two of the ceasefire, which may translate into increased US pressure to facilitate further implementation of the ceasefire. This potentially includes additional force withdrawals in the Gaza Strip (to the 40 percent line), which Israel will push to delay, viewing a bolstered Israel Defense Forces (IDF) presence in Gaza as a necessary security measure. This assessment will be fueled by the Israeli understanding that Hamas is not intending to disarm but rather only symbolically dilute its public presence, which will likely impede the truce’s advancement. This was underscored by a report indicating Hamas’s desire to integrate its 10,000-member police force under the new technocratic administration in Gaza. Against this backdrop, the ceasefire’s progression will likely face persistent obstacles in terms of securing investments for reconstruction, with Israel employing significant lobbying to convince Washington to take a tough stance on Hamas.

Source: IDF

Libya

Current Situation

- According to unconfirmed reports dated January 21, a sanctioned Russian vessel “Mys Zhelaniya” was seen in eastern Libya’s Tobruk, allegedly carrying military equipment.

- The vessel reportedly was escorted by a Russian Udaloy-class naval destroyer.

Assessments & Forecast: Tobruk port is under the control of the Khalifa Haftar-led Libyan National Army (LNA). Russian engagement with the LNA has advanced considerably since the fall of the Bashar al-Assad government in December 2024. These circumstances have prompted Russia to consider eastern Libya a likely alternative for hosting military assets in the Mediterranean after restricted access to bases in Syria, including Tartus and Hmeimim. The purported escort by a Russian warship lends credence to assessments that the vessel was possibly transporting military cargo intended for Russian forces in Libya and in other African regions, including personnel associated with the paramilitary Africa Corps. It also remains possible that part of the equipment was transferred to the LNA. In either case, whether the shipment supports Russian force enhancement or the LNA’s efforts to expand its inventory, the transfer is likely to directly or indirectly strengthen the LNA’s regional position. If similar shipments are recorded more often, the pattern would indicate the potential emergence of eastern Libya as a strategic base for Russian operations in the Mediterranean. The ship’s docking despite the ongoing UN-enforced arms embargo on Libya indicates major gaps in monitoring and intercepting vessels transporting weapons to Libya, regardless of the intended recipient. There remains a possibility that similar shipments will occur in the coming months.

Source: Libya Observer ; Business Insider Africa

Syria

Current Situation

- On January 23, the Syrian Arab Army (SAA) took control of al-Aqtan prison in northeastern Syria’s Raqqa province following the negotiated withdrawal of the Syrian Democratic Forces (SDF).

- On January 24, the Syrian Ministry of Defense announced a 15-day extension of the ceasefire with the SDF. The ministry stated that the extension was intended to support US operations to transfer Islamic State (IS) detainees from SDF-run prisons to Iraq.

- Since January 25, both the Syrian government and the SDF have reportedly accused each other of violating the ceasefire.

Assessments & Forecast: These developments follow the SAA’s takeover of extensive territory held by the SDF between January 16-18, which culminated in a four-day ceasefire on January 20. In this context, the peaceful transfer of al-Aqtan prison reflects a recalibration after recent clashes, with the SDF likely concluding that continued resistance was unsustainable given degraded capabilities and the high likelihood that SAA forces would eventually seize the facility. This, combined with the ceasefire extension, reflects both sides’ interest in preserving stability while sensitive security and political arrangements regarding the SDF’s integration into the Syrian state are finalized. Over the coming week, both sides are expected to use the relative calm to pursue confidence-building measures, including deconfliction mechanisms and dialogue on administrative and military integration frameworks. By framing the extension as support for ongoing US counter-IS operations, Damascus is likely seeking to project an image of responsible governance while consolidating control over newly seized territories and facilities, thus increasing pressure on the SDF to comply with the agreement. Despite mutual accusations of ceasefire violations, reports indicate that both sides continue to engage on the terms of the January 18 agreement. Nevertheless, the ceasefire is likely to remain fragile, with localized clashes likely to recur near al-Hasakah, Kobani, and Qamishli.

Source: Syrian MoD

UAE

Current Situation:

- According to January 20 reports, the UAE and India signed a Letter of Intent (LoI) to establish a Strategic Defence Partnership during UAE President Sheikh Mohamed bin Zayed al Nahyan’s visit to New Delhi.

- Both sides also reaffirmed their goal of expanding bilateral trade to 200 billion USD by 2032 and finalized a ten-year LNG agreement, under which the Abu Dhabi National Oil Company (ADNOC) Gas will supply India with 500,000 metric tons of LNG annually.

- According to January 23 unconfirmed reports, the UAE withdrew from a deal to manage Pakistan’s Islamabad Airport.

Assessments & Forecast: The agreements with New Delhi align with Abu Dhabi’s broader strategy to deepen strategic partnerships across Asia and Africa. Economically, they build on the 2022 Comprehensive Economic Partnership Agreement (CEPA) with India, reinforcing trade expansion and long-term energy cooperation. The LNG deal in particular supports this objective by securing stable demand for UAE gas exports amid continued volatility in global energy markets. The defense component, however, carries notable geopolitical significance. The LoI comes amid ongoing UAE–Saudi frictions and increasing alignment between Saudi Arabia and Pakistan. In this context, Abu Dhabi’s latest moves are aimed at diversifying its strategic partnerships and counterbalancing Riyadh’s deepening security ties with Islamabad through closer engagement with New Delhi. This approach is further shaped by competitive dynamics in Africa, where Saudi Arabia has sought to offset the UAE’s expanding influence, particularly in Sudan and Somalia. Taken together, deeper UAE–India coordination reflects converging strategic interests and points to a likely expansion of bilateral cooperation in the coming months.

Source: Middle East Eye 2

Other Developments

Algeria: On January 24, the Algerian Foreign Ministry announced that it summoned the French Embassy’s charge d’affaires to object to a documentary aired by a French state-run channel covering the strained relations between the two countries.

Iraq: The Shiite Coordination Framework (CF), the largest parliamentary bloc, nominated former Prime Minister (PM) Nouri al-Maliki as the PM designate on January 24 amid ongoing government formation efforts.

Iraq & Syria: US Central Command (CENTCOM) announced the transport of 150 Islamic State (IS) fighters from a prison in Syria’s al-Hasakah to detention facilities in Iraq on January 21.

Israel: Tens of thousands of Arab-Israelis gathered in northern Israel’s Sakhnin on January 22 to denounce rising violent crime within Arab communities and the perceived government inaction against the phenomenon.

Syria: According to an unconfirmed January 22 report, the US is considering a complete withdrawal of US troops that had originally been deployed in Syria to support operations against IS.

Turkey: The Republican People’s Party (CHP) condemned the January 23 court rejection of a lawsuit challenging the revocation of the university degree of CHP Presidential candidate and former Istanbul Mayor Ekrem Imamoglu.

Yemen & UAE: The Saudi-backed Presidential Command Council (PCC)-led Ministry of Electricity and Energy accused an Emirati energy company on January 22 of shutting down solar power plants in Aden and Shabwa without prior coordination.

The Upcoming Week

- January 31: Member of the Knesset (MK) Ayman Odeh called for a demonstration in Israel’s Tel Aviv during the evening hours (local time) to denounce rising crime in the Arab sector.

- January 31: Morocco’s “National Action Group for Palestine” called for a nationwide Global Day of Solidarity to demand freedom for Palestinian detainees in Israeli prisons.

- January 31: The Riyadh Marathon will take place in Saudi Arabia. The race will begin at 06:25 (local time) from Princess Nourah Bint Abdulrahman University.

- February 1: The UAE’s Dubai Marathon 2026 is set to begin at 05:45 (local time) at al-Taryam Road. Additional information about the marathon route can be found here.

Highlights of the Week

This report reviews notable events in the Middle East and North Africa this week. These include Israel’s recovery of the final deceased hostage from Gaza, the alleged arrival of a sanctioned Russian vessel in eastern Libya’s Tobruk, the latest 15-day ceasefire between the government and Kurdish forces in Syria, strengthening ties between the UAE and India, and the increasing risk of military confrontation between the US and Iran, and the associated ripple escalation risk across the MENA region.

MENA

Current Situation

- On January 26, US Central Command (CENTCOM) confirmed that the USS Abraham Lincoln Carrier Strike Group (CSG) has been deployed in its area of responsibility.

- In an interview published on January 26, US President Donald Trump stated that Iran has repeatedly reached out to Washington, saying it “wants to talk.”

Assessments & Forecast: The arrival of USS Abraham Lincoln marks the culmination of a broad US military buildup in the region over the past week. These deployments are notable and reflect the amassing of a range of assets that increase Washington’s strike options. This increases the prospects for military confrontation between the US and Iran. That said, the arrival of the CSG is not necessarily indicative of imminent military action, an assessment lent some credence by President Trump’s remarks raising the possibility of negotiations with Tehran. However, the US would likely table an uncompromising deal aimed at eliciting extensive commitments from Iran on nuclear enrichment, its ballistic missile arsenal, and proxy network. This is based on the assessment that in its weakened position, Iran will show greater flexibility on these core issues. However, as precedent indicates, Iran is unlikely to agree to these demands, which it perceives as fundamental to its deterrent capabilities. Against this backdrop of an increasing risk of military confrontation, Iran-backed regional allies, including Kataib Hezbollah, Hezbollah, and the Houthis have begun to express their willingness to engage in attacks in solidarity with their patron. In a military flare-up scenario, attacks by these actors are more likely to manifest in UAV/limited ballistic missile attacks on US assets in the region, Israel, and/or regional maritime routes, including the Red Sea, Gulf of Aden, and Persian Gulf. This would also risk drawing Israel into the fray and elicit retaliatory Israeli/US strikes on Axis of Resistance strongholds, potentially extending to Lebanon, Iraq, and Yemen. Overall, this underscores the escalation risk across the region.

Source: US CENTCOM

Israel & Palestinian Territories

Current Situation

- On January 22, US Envoy Jared Kushner unveiled the US reconstruction plan for Gaza. He stated that the next step would be “working with Hamas on demilitarization,” and that no investment would be made without security.

- On January 26, Israel recovered the remains of the final deceased hostage in Gaza. This was facilitated by intelligence gained in interrogations of a Palestinian Islamic Jihad (PIJ) detainee.

- In a press conference on January 27, Prime Minister (PM) Benjamin Netanyahu reiterated his narrative that Hamas will disarm “the easy way or the hard way.” He further stated that reconstruction will not begin before disarmament and that Turkish and Qatari forces will not enter Gaza.

Assessments & Forecast: Envoy Kushner’s plan underscores Washington’s intent to advance the ceasefire framework and initiate Gaza’s reconstruction and development process, beginning with Rafah. The return of the final hostage marks the removal of a key obstacle to Jerusalem’s participation in Phase Two of the ceasefire, which may translate into increased US pressure to facilitate further implementation of the ceasefire. This potentially includes additional force withdrawals in the Gaza Strip (to the 40 percent line), which Israel will push to delay, viewing a bolstered Israel Defense Forces (IDF) presence in Gaza as a necessary security measure. This assessment will be fueled by the Israeli understanding that Hamas is not intending to disarm but rather only symbolically dilute its public presence, which will likely impede the truce’s advancement. This was underscored by a report indicating Hamas’s desire to integrate its 10,000-member police force under the new technocratic administration in Gaza. Against this backdrop, the ceasefire’s progression will likely face persistent obstacles in terms of securing investments for reconstruction, with Israel employing significant lobbying to convince Washington to take a tough stance on Hamas.

Source: IDF

Libya

Current Situation

- According to unconfirmed reports dated January 21, a sanctioned Russian vessel “Mys Zhelaniya” was seen in eastern Libya’s Tobruk, allegedly carrying military equipment.

- The vessel reportedly was escorted by a Russian Udaloy-class naval destroyer.

Assessments & Forecast: Tobruk port is under the control of the Khalifa Haftar-led Libyan National Army (LNA). Russian engagement with the LNA has advanced considerably since the fall of the Bashar al-Assad government in December 2024. These circumstances have prompted Russia to consider eastern Libya a likely alternative for hosting military assets in the Mediterranean after restricted access to bases in Syria, including Tartus and Hmeimim. The purported escort by a Russian warship lends credence to assessments that the vessel was possibly transporting military cargo intended for Russian forces in Libya and in other African regions, including personnel associated with the paramilitary Africa Corps. It also remains possible that part of the equipment was transferred to the LNA. In either case, whether the shipment supports Russian force enhancement or the LNA’s efforts to expand its inventory, the transfer is likely to directly or indirectly strengthen the LNA’s regional position. If similar shipments are recorded more often, the pattern would indicate the potential emergence of eastern Libya as a strategic base for Russian operations in the Mediterranean. The ship’s docking despite the ongoing UN-enforced arms embargo on Libya indicates major gaps in monitoring and intercepting vessels transporting weapons to Libya, regardless of the intended recipient. There remains a possibility that similar shipments will occur in the coming months.

Source: Libya Observer ; Business Insider Africa

Syria

Current Situation

- On January 23, the Syrian Arab Army (SAA) took control of al-Aqtan prison in northeastern Syria’s Raqqa province following the negotiated withdrawal of the Syrian Democratic Forces (SDF).

- On January 24, the Syrian Ministry of Defense announced a 15-day extension of the ceasefire with the SDF. The ministry stated that the extension was intended to support US operations to transfer Islamic State (IS) detainees from SDF-run prisons to Iraq.

- Since January 25, both the Syrian government and the SDF have reportedly accused each other of violating the ceasefire.

Assessments & Forecast: These developments follow the SAA’s takeover of extensive territory held by the SDF between January 16-18, which culminated in a four-day ceasefire on January 20. In this context, the peaceful transfer of al-Aqtan prison reflects a recalibration after recent clashes, with the SDF likely concluding that continued resistance was unsustainable given degraded capabilities and the high likelihood that SAA forces would eventually seize the facility. This, combined with the ceasefire extension, reflects both sides’ interest in preserving stability while sensitive security and political arrangements regarding the SDF’s integration into the Syrian state are finalized. Over the coming week, both sides are expected to use the relative calm to pursue confidence-building measures, including deconfliction mechanisms and dialogue on administrative and military integration frameworks. By framing the extension as support for ongoing US counter-IS operations, Damascus is likely seeking to project an image of responsible governance while consolidating control over newly seized territories and facilities, thus increasing pressure on the SDF to comply with the agreement. Despite mutual accusations of ceasefire violations, reports indicate that both sides continue to engage on the terms of the January 18 agreement. Nevertheless, the ceasefire is likely to remain fragile, with localized clashes likely to recur near al-Hasakah, Kobani, and Qamishli.

Source: Syrian MoD

UAE

Current Situation:

- According to January 20 reports, the UAE and India signed a Letter of Intent (LoI) to establish a Strategic Defence Partnership during UAE President Sheikh Mohamed bin Zayed al Nahyan’s visit to New Delhi.

- Both sides also reaffirmed their goal of expanding bilateral trade to 200 billion USD by 2032 and finalized a ten-year LNG agreement, under which the Abu Dhabi National Oil Company (ADNOC) Gas will supply India with 500,000 metric tons of LNG annually.

- According to January 23 unconfirmed reports, the UAE withdrew from a deal to manage Pakistan’s Islamabad Airport.

Assessments & Forecast: The agreements with New Delhi align with Abu Dhabi’s broader strategy to deepen strategic partnerships across Asia and Africa. Economically, they build on the 2022 Comprehensive Economic Partnership Agreement (CEPA) with India, reinforcing trade expansion and long-term energy cooperation. The LNG deal in particular supports this objective by securing stable demand for UAE gas exports amid continued volatility in global energy markets. The defense component, however, carries notable geopolitical significance. The LoI comes amid ongoing UAE–Saudi frictions and increasing alignment between Saudi Arabia and Pakistan. In this context, Abu Dhabi’s latest moves are aimed at diversifying its strategic partnerships and counterbalancing Riyadh’s deepening security ties with Islamabad through closer engagement with New Delhi. This approach is further shaped by competitive dynamics in Africa, where Saudi Arabia has sought to offset the UAE’s expanding influence, particularly in Sudan and Somalia. Taken together, deeper UAE–India coordination reflects converging strategic interests and points to a likely expansion of bilateral cooperation in the coming months.

Source: Middle East Eye 2

Other Developments

Algeria: On January 24, the Algerian Foreign Ministry announced that it summoned the French Embassy’s charge d’affaires to object to a documentary aired by a French state-run channel covering the strained relations between the two countries.

Iraq: The Shiite Coordination Framework (CF), the largest parliamentary bloc, nominated former Prime Minister (PM) Nouri al-Maliki as the PM designate on January 24 amid ongoing government formation efforts.

Iraq & Syria: US Central Command (CENTCOM) announced the transport of 150 Islamic State (IS) fighters from a prison in Syria’s al-Hasakah to detention facilities in Iraq on January 21.

Israel: Tens of thousands of Arab-Israelis gathered in northern Israel’s Sakhnin on January 22 to denounce rising violent crime within Arab communities and the perceived government inaction against the phenomenon.

Syria: According to an unconfirmed January 22 report, the US is considering a complete withdrawal of US troops that had originally been deployed in Syria to support operations against IS.

Turkey: The Republican People’s Party (CHP) condemned the January 23 court rejection of a lawsuit challenging the revocation of the university degree of CHP Presidential candidate and former Istanbul Mayor Ekrem Imamoglu.

Yemen & UAE: The Saudi-backed Presidential Command Council (PCC)-led Ministry of Electricity and Energy accused an Emirati energy company on January 22 of shutting down solar power plants in Aden and Shabwa without prior coordination.

The Upcoming Week

- January 31: Member of the Knesset (MK) Ayman Odeh called for a demonstration in Israel’s Tel Aviv during the evening hours (local time) to denounce rising crime in the Arab sector.

- January 31: Morocco’s “National Action Group for Palestine” called for a nationwide Global Day of Solidarity to demand freedom for Palestinian detainees in Israeli prisons.

- January 31: The Riyadh Marathon will take place in Saudi Arabia. The race will begin at 06:25 (local time) from Princess Nourah Bint Abdulrahman University.

- February 1: The UAE’s Dubai Marathon 2026 is set to begin at 05:45 (local time) at al-Taryam Road. Additional information about the marathon route can be found here.