Yemen & Saudi Arabia Analysis: Houthis escalate rhetoric against Riyadh over UN-sponsored 2023 roadmap; highlights risk of friction despite likely low interest to renew cross-border conflict

Executive Summary:

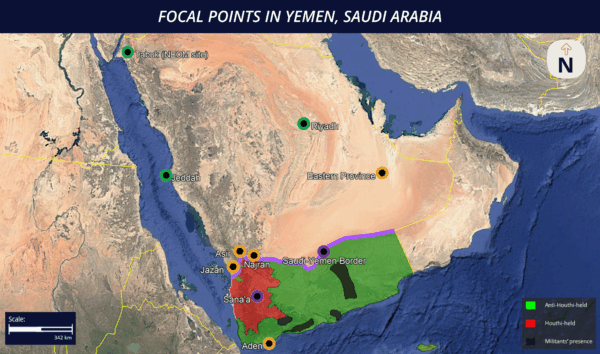

- In recent weeks, Houthi officials have significantly intensified their rhetoric against Saudi Arabia, aiming to pressure Riyadh into accepting the 2023 UN-brokered roadmap.

- This was accompanied by on-ground developments, including large-scale mobilization of tribal forces and military drills near the Saudi-Yemeni border, signaling potential Houthi readiness to apply additional pressure.

- At the current juncture, both Saudi Arabia and the Houthis likely retain an interest in avoiding a renewed cross-border conflict, reducing the prospects for large-scale Houthi aerial attacks against Saudi strategic infrastructures.

- Nevertheless, there remains a possibility that talks would break down or that the Houthis would resort to cross-border attacks against Saudi soil to improve their leverage.

- Monitor regional developments and conduct more frequent risk assessments for business travel to and operations at key Saudi infrastructure.

Current Situation:

Political statements:

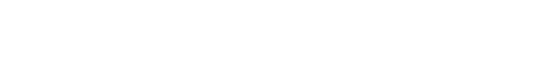

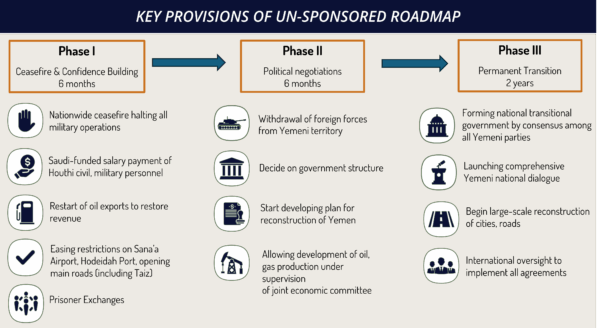

- On October 29, the official spokesperson of the Houthis, Mohamed Abdulsalam, met with UN Special Envoy Hans Grundberg to discuss reactivating and enforcing the UN-backed Yemen roadmap. The plan, brokered by Grundberg in December 2023, outlines commitments to a nationwide ceasefire and a series of economic measures.

- Between October 27 and November 23, the UN Special Envoy to Yemen, Hans Grundberg, visited Oman and Bahrain as part of the UN’s efforts to engage the parties to the Yemeni conflict and advance negotiations toward a political settlement.

- Grundberg stated that the regional context provides an opportunity to revive momentum toward de-escalation and bolstering dialogue in support of the peace track in Yemen. He called on “all parties to exercise restraint, engage in dialogue, and take practical steps to alleviate the sufferings of Yemenis.” Grundberg also met with the Houthis’ Chief Negotiator to discuss the need for a conducive environment for a meaningful and inclusive political process.

General Developments:

- On November 9, the Sana’a-based Houthi Ministry of Interior announced the arrest of an espionage network allegedly linked to a Saudi Arabia-based joint operations room run by the CIA, Israel’s Mossad, and the Saudi intelligence.

- The defendants have been charged with “espionage activities involving foreign countries hostile to the Houthis, including the US, the UK, and Israel.” Specific charges against the detainees include assisting the Saudi-led coalition in its war against the group, collecting military and political intelligence on senior Houthi officials, and geolocating military infrastructure within Houthi-held areas. On November 9, a trial was initiated against the defendants.

- On November 22, a Houthi-controlled court sentenced 17 Yemenis to death by firing squad, issued ten-year prison terms to two others, and acquitted one. Prosecutors accused the defendants of spying for Saudi, UK, US, and Israeli intelligence services between 2024 and 2025.

Assessments & Forecast:

Key hurdles derailing the UN-sponsored peace framework

- Since late October, the Houthis have intensified pressure on Saudi Arabia to meet what they describe as its financial commitments under the Oman-mediated roadmap. Initially launched in 2022 after the UN-brokered truce between the Presidential Command Council (PCC) and the Houthis, the roadmap was finalized in December 2023 following extensive consultations involving Oman, the UN Special Envoy, Saudi Arabia, and the Houthis. It envisioned a permanent ceasefire, mechanisms for allocating oil revenues to fund public-sector salaries, and a broader framework for a lasting political settlement.

- For Saudi Arabia, the roadmap was an opportunity to draw down its costly military involvement while securing Houthi commitments to cease cross-border attacks, which are essential to its national economic transformation. This also meant enabling direct negotiations between the Houthis and the PCC. Although neither side formally signed the agreement, both endorsed it in principle as a pathway to permanent conflict resolution.

- However, the roadmap talks stalled under a series of compounding crises and structural contradictions. The roadmap lacked binding sequencing and enforcement mechanisms, allowing each party to interpret obligations through its own interests. Salary payments became an early flashpoint of tensions. The Houthis expected roughly 100 million USD per month under the roadmap. The agreement also relied on 2014 payroll lists, even though the Houthis had since replaced many civil servants with loyalists and new military recruits. This meant that most personnel under Houthi control would not be paid, prompting the group to demand direct access to funds to maintain administrative and military financing. Riyadh and the PCC insisted on oversight to prevent funds from being diverted to military use, while the Houthis demanded direct transfers.

- At the same time, Houthi maritime attacks escalated sharply in the wake of the Gaza war, with the group abandoning de-escalation and intensifying Red Sea operations to position itself as a key element of the regional Iran-led “Axis of Resistance.” By March 2024, these actions led the PCC to suspend roadmap implementation. The situation worsened when the Trump administration redesignated the Houthis as a Foreign Terrorist Organization (FTO). Because many of the roadmap’s core provisions required Saudi Arabia to interface directly or indirectly with Houthi-controlled institutions, such as transferring revenue to Sana’a, funding civil and military salaries, coordinating customs revenues, and permitting the expansion of international flights or commercial shipping through Hodeidah and Sana’a airports, the FTO designation made these steps effectively illegal. Any Saudi government action that resulted in financial benefit to Houthi authorities would risk violating US terrorism financing laws, leaving Riyadh unable to carry out the economic and logistical commitments required to operationalize the roadmap.

- The roadmap also alienated key Yemeni actors, particularly the Southern Transitional Council (STC), which rejected the bilateral Saudi-Houthi framework and deepened fractures within the anti-Houthi camp. The STC made clear it would not accept any deal that sidesteps southern interests or reallocates oil and gas revenues without its consent. Leaked early drafts hinting at economic concessions to the Houthis at the South’s expense triggered a strong STC pushback.

- Subsequently, Saudi Arabia, under growing US pressure, reportedly pushed to revise the roadmap to include Houthi disarmament in line with UN Security Council (UNSC) Resolution 2216, which calls for restoring state authority and dismantling armed groups. While unconfirmed, this is plausible given Riyadh’s view that the Houthis were politically vulnerable at the time. It also aligned with the Trump administration’s “maximum pressure” campaign against Iran, reflecting efforts to weaken Tehran’s regional allies. However, the Houthis rejected such disarmament conditions. They framed the Saudi push for modified conditions as capitulation to US pressure and as evidence that the original roadmap was being unilaterally abandoned.

- Saudi policymakers likely eventually recognized that key elements of the roadmap created a paradox. Funding salaries in Houthi-held areas and allowing expanded port revenues at Hodeidah would bolster Houthi administrative capacity and long-term institutional resilience. With stable revenue streams, the Houthis could allocate greater resources to upgrading military capabilities, accelerating drone and missile development, and strengthening deterrence. This realization helps explain Riyadh’s hesitation to implement the roadmap as initially drafted and its move to condition progress on disarmament and security guarantees, seeking concessions that could offset the strategic advantages the Houthis stood to gain through economic consolidation.

Houthi motivations to pressure Riyadh to implement the roadmap

Economic factors

- The Houthis pushed more strongly for the roadmap following the Israel-Hamas ceasefire that was implemented in October. With that front de-escalating, the group shifted its rhetoric and pressure toward Saudi Arabia, openly declaring that the Gaza ceasefire “allows for bolstering the dialogue regarding the roadmap in Yemen.” Their urgency was reinforced by mounting economic strain, further worsened by the costs the Houthis incurred for their participation in the conflict. This mainly pertains to Israeli and US strikes in 2024-25 that degraded key revenue sources and infrastructures. The targeting of Ras Isa and Hodeidah ports disrupted major fuel profits and customs revenue, resulting in over one billion USD in damage. The extensive attacks on the Sanaa International Airport destroyed the national carrier’s fleet and disrupted flight operations, causing nearly 500 million USD in losses.

- The Trump administration’s FTO designation further restricted financial transactions, access to imports, and economic engagement in Houthi-held areas, contributing to a sharp decline in remittances to northern Yemen. Domestically, liquidity was further strained by the Aden-based Central Bank’s directive for banks in Houthi territory to relocate their headquarters to Aden. The Houthi decision in August to introduce new currency, publicly described as replacing damaged notes, was in reality an emergency response to severe liquidity shortages.

- Household conditions in Houthi-controlled areas of Yemen continue to deteriorate. Prices for staple goods remained high while wages stagnated, sharply eroding purchasing power. Only a small portion of the population receives regular salaries, and many families rely on casual labor, aid, or informal trade. An early 2024 report indicated that only around three percent of residents in Houthi-controlled areas were receiving consistent income, and additionally, more than 60 percent faced food insecurity. Securing public sector salary payments through the roadmap, therefore, became critical from the Houthi perspective, providing a means to stabilize governance in Sanaa, Hodeidah, and other key cities and reduce reliance on Iranian financial support.

Strengthening of the anti-Houthi bloc

- The Houthis also believe the anti-Houthi camp is strengthening. Saudi Arabia’s recent diplomatic and security initiatives have heightened the group’s threat perceptions. In September, Riyadh and the UK co-hosted a high-level conference attended by representatives from 35 states, who pledged millions in the first phase of a ten-year plan to strengthen the PCC-affiliated Coast Guard and counter smuggling and piracy in Yemeni waters.

- Operationally, PCC-aligned forces have also tightened maritime pressure. Multiple successful interceptions of Iranian weapon shipments in recent months, including the high-profile July 16 seizure, have constrained Houthi logistical flows and contributed to growing strategic concern in Sana’a regarding its freedom of action in the Red Sea.

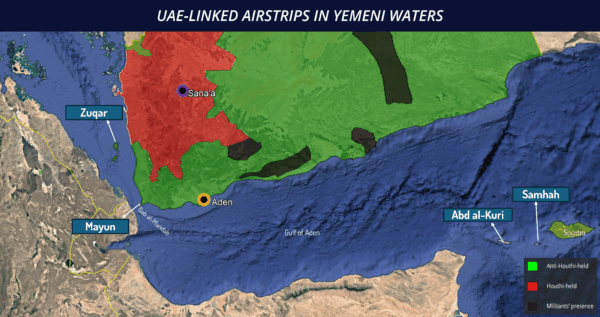

- A related major pressure factor is the apparent expanding Emirati military buildup around Yemen, which the Houthis likely perceive as a strategic threat. This has been most evident through a network of new and upgraded airstrips across Zuqar Island, Socotra, and Mayun. Satellite imagery from October 2025 indicates that Zuqar Island hosts a nearly completed 2,000-meter airstrip (construction began in April 2025), a jetty, and associated logistics facilities. The site includes one operational aircraft hangar and another under construction, linked by a taxiway to two military emplacements. There are also new airstrips on Socotra’s Abd al-Kuri and Samhah, as well as Mayun Island, located at the Bab al-Mandab Strait.

- This buildup of infrastructure on Yemen’s Islands is likely to enhance oversight over movements in the Red Sea and the Yemeni coastline. It likely strengthens real-time monitoring of Houthi activity, supports the interception of Iranian weapons shipments, allows the launch of reconnaissance and limited strike missions against mainland targets, and facilitates surveillance of commercial shipping transiting the Red Sea.

- The UAE’s expanded infrastructure in Somalia’s Bosaso and Berbera extends the network into the Horn of Africa. For example, the Houthis viewed the UAE’s installation of a radar system in Bosaso as a direct escalation and, in April 2025, threatened to target this infrastructure.

Time-lapse of satellite imagery depicting the construction of airstrips surrounding Yemen (1 – Mayun, 2 – Abd al-Kuri, 3 – Samhah, 4 – Zuqar)

Signs of increasing tensions between the Houthis and Riyadh

- It is primarily the Houthis’ media campaigns and statements by senior political leaders that signal a noticeable escalation in tensions with Saudi Arabia. The Houthis have intensified efforts to cast Saudi Arabia as responsible for Yemen’s worsening economic conditions. The group’s senior leadership has escalated anti-Saudi rhetoric, signaling a psychological pressure campaign. Recent statements demonstrate a sharper tone and intent. For example, Politburo member Hezam al-Asad implicitly threatened attacks on Aramco and the Crown Prince’s flagship NEOM project. Meanwhile, in recent weeks, Houthi-affiliated media have been publishing reports of artillery and rocket shelling targeting Saada governorate border areas, describing these as “Saudi aggression.” These reports were prevalent in the past and have subsided over the past two years. Thus, their return signals a deliberate media campaign to revive narratives pertaining to an external Saudi threat.

- This renewed discourse, combined with accusations that Saudi Arabia is supporting Israel, suggests a deliberate reframing of bilateral tensions as part of a larger confrontation aligned with the regional “resistance” narrative. By positioning the escalation with Saudi Arabia within its anti-Israel posture, the group reinforces ideological cohesion and legitimacy. This approach was evident in Abdul Malik al-Houthi’s late September speech, in which he accused Saudi Arabia of protecting Israeli shipping in the Red Sea and warned that their efforts “will be in vain.”

- The subsequent Houthi claims of uncovering a Saudi-led espionage network, accompanied by released “confessions,” reinforce their narrative portraying Riyadh as aligned with Israel. Their messaging accuses Riyadh of aiding Israel through intelligence sharing and destabilizing Yemen. The Houthis tied these claims to the broader regional trajectory of normalization, arguing that Saudi Arabia’s potential entry into the Abraham Accords would create a new security framework involving the US and Israel at Yemen’s expense. By positioning normalization as proof of Saudi-Israeli/US collusion, they sought to elevate the bilateral conflict into part of the wider Iran-led Axis of Resistance struggle. This explains why Houthi social media accounts and broader messaging strenuously opposed the latest meeting between Crown Prince Mohammed bin Salman (MbS) and Donald Trump. They viewed this engagement as further evidence that Saudi Arabia is positioning itself within the US orbit under President Trump.

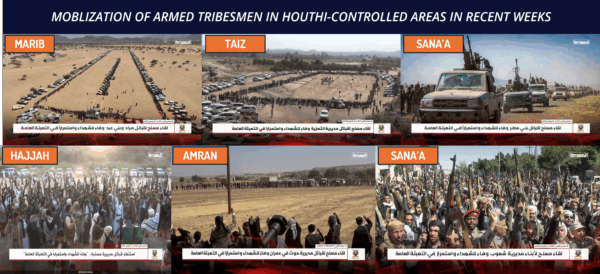

- Over the past several weeks, the Houthis have undertaken a coordinated campaign of military exercises, political signaling, and public mobilization to demonstrate combat readiness. In mid-November, multiple armed tribesmen in Ibb and Hajjah announced full preparedness for confrontation and reaffirmed loyalty to Houthi leader Abdulmalik al-Houthi. These declarations followed a national call for general mobilization on November 9, accompanied by large-scale armed rallies across Houthi-controlled areas, signaling alignment with the leadership. Concurrently, the Houthis have expanded the systematic militarization of Yemen’s university system, with thousands of students completing training in weapons handling, drone operations, and ideological instruction, thereby likely expanding reserve force capacity. Persistent rallies by armed tribesmen, ongoing recruitment, and field exercises, including operations in Saada, approximately five kilometers from the Saudi border, highlight these force buildup efforts.

- Taken together, these developments suggest that the Houthi leadership is at least preparing for a scenario in which political negotiations fail, and confrontation becomes increasingly probable. This was also supported by the UN Security Council (UNSC) Panel of Experts on Yemen, which stated in its latest report from October that “the Houthis’ armed forces increased their combat readiness and preparedness.”

Riyadh will prioritize pursuing negotiations in parallel to efforts to gain a qualitative military edge

- Saudi Arabia has demonstrated a clear preference for a negotiated settlement over military escalation in recent weeks, culminating in talks in Muscat in late October 2025. This approach is driven primarily by economic calculations, especially the need to safeguard the domestic transformation agenda under Vision 2030. Prolonged regional instability risks undermining investor confidence, which is critical to sustaining growth and financing major development projects. A renewed conflict would expose high-value infrastructure and economic centers to Houthi targeting, creating significant financial and reputational risk. Additionally, Saudi Arabia’s pursuit of major international ventures, including hosting the 2034 FIFA World Cup and bidding for other global events, provides further incentive to avoid large-scale escalation. Collectively, these factors reinforce Riyadh’s strategic interest in limiting regional volatility and prioritizing diplomatic avenues.

- Riyadh has therefore sought to compensate for its limited ability to independently reopen Sana’a airport and Hodeidah port by offering a set of discreet economic incentives to the Houthis. These reportedly include allowing Houthi authorities to secure legal aviation licenses from the PCC to establish a Houthi-operated airline. Saudi Arabia has reportedly reinstated long-standing financial grants for tribal leaders and select Houthi officials, instead of resuming salary payments to civil servants in Houthi-controlled areas, alleviating pressure on the group’s patronage networks. This approach delivers indirect economic benefits while avoiding the legal risks of directly funding an FTO-designated entity. Concurrently, Riyadh has reportedly pressed the PCC’s National Committee for the Regulation and Financing of Imports to allow Houthi-affiliated companies to engage in import activity, ease restrictions on their commercial operations, and facilitate increased trade flows through Hodeidah port. Collectively, these measures are meant to enable the Houthis to collect customs duties and taxes on significantly expanded import volumes without direct financial transfers from Saudi Arabia.

- This indicates that Riyadh remains willing to make economic concessions to prevent a collapse of the truce. Such calibrated concessions underscore Saudi Arabia’s assessment that the political and financial costs of renewed large-scale conflict outweigh the risks of limited economic accommodation. As a result, these measures are likely to continue serving as a stabilizing factor in the near term, reducing the immediate likelihood of a return to open conflict even as core political disputes remain unresolved.

- Meanwhile, Riyadh is working to bolster its long-term security relationships, with its alliance with the US at the core. The November US-Saudi Strategic Defense Agreement cemented this relationship by granting Riyadh Major Non-NATO Ally status, prioritizing defense cooperation, integrating intelligence sharing, and providing access to advanced systems, including F-35 fighter aircraft, Abrams tanks, and comprehensive air defense capabilities. Complementing this, the Strategic Mutual Defense Agreement with Pakistan highlights Riyadh’s push to expand strategic defense pacts with allies. Other initiatives include regional military coordination in exercises like Red Wave 8, which integrate naval, air, and coastal forces across multiple Gulf states.

- Collectively, these measures furnish Saudi Arabia with more robust security guarantees and measures to gain a qualitative military edge in the long term. This further incentivizes Riyadh to pursue a de-escalatory stance in the short term.

Forecasting Houthi pressure tactics against Saudi Arabia in the near term

- FORECAST: The likelihood of the Houthis initiating a full-scale offensive against Saudi Arabia remains relatively low at present, given ongoing diplomatic efforts and indications that the Houthis still retain an overall interest in maintaining calm. To some extent, this Houthi interest is likely influenced by the weakened position of Iran’s Axis of Resistance camp in the wake of its 12-day war with Israel. In this context, Iran is likely partially turning its attention inwards, dedicating extensive efforts to replenish its own drone and ballistic missile arsenal in anticipation and concern of future rounds of hostilities with Israel. This likely decreases to some extent Tehran’s ability to extend material and financial support to the Houthis, likely bolstering the Houthis’ interest in preserving their resources for future rounds of hostilities with Israel.

- Under these circumstances, Houthi dissatisfaction and a desire to increasingly pressure Riyadh are more likely to manifest in gradual, limited escalatory actions designed to give the Saudi leadership time to cave in to Houthi demands without risking a full-scale flare-up of hostilities. In this context, limited cross-border attacks along the Saudi-Yemen frontier remain a possibility as part of Houthi efforts to increase their leverage.

- FORECAST: At the same time, Houthi rhetoric against Saudi Arabia is expected to remain a primary coercive tool, serving as a visible indicator of dissatisfaction with the progress of negotiations. Senior leaders continue to issue explicit threats, often invoking historical reminders of high-impact strikes to reinforce credibility.

- FORECAST: The Houthis will also continue to prioritize reinforcing military positions against anti-Houthi formations. As a result, force deployments, logistical buildup, and mobilization of fighters will continue over the coming months, increasing tensions along frontlines overall.

Assessing Houthi capabilities, and target banks in case of renewed Saudi-Houthi conflict

- Over the past two years, the Houthis have crystallized their transition from an actor with a limited outreach within the context of the Yemen civil war to a strategic, regional actor employing force at ranges exceeding 2,000 km in response to regional crises. Their drone and missile attacks against Israel constituted the longest-range sustained offensive campaign by a non-state force, involving over 200 missiles and drones, several of which have penetrated Israeli air and missile defenses.

- These qualitative leaps, manifested in the Houthis’ continued improvement in UAV and missile technology with Iranian support, enable them to exploit vulnerabilities and impose costs on regional state actors, including those with advanced aerial defenses. This increases the Houthis’ deterrence and the overall threat they pose to Saudi Arabia and the UAE should major hostilities break out, with Houthi operational ranges covering the entirety of the Gulf region.

- In addition, their maritime attack campaign in the Red Sea and Gulf of Aden was the most effective maritime disruption effort ever conducted by a non-state actor, with more than 300 attacks by 2025 and over 100 commercial vessels targeted, largely through relatively low-cost drones and missiles. At the same time, their ability to intercept and shoot down 14 MQ-9 Reaper drones further highlights improvements in air defenses.

- Despite more than 1,200 US airstrikes between March and May, the Houthis retained operational continuity, rebuilt critical infrastructure, and continued launching drones, ballistic missiles, and surface-to-air munitions, reflecting the resilience of their distributed manufacturing, underground storage systems, and supply chains.

- The movement fields a diversified and integrated strike arsenal that includes long-range UAVs and a growing inventory of ballistic and cruise missiles. By late 2025, the group is reportedly assessed to retain more than 200 ballistic missiles, 100 cruise missiles, substantial UAV inventories, anti-ship weapons, and air defense systems, which could facilitate months of high-tempo operations.

- A complete breakdown in negotiations could prompt Houthi strikes against strategic Saudi sites, including in Riyadh, as well as key economic assets across the kingdom, such as the Eastern Province’s energy facilities of Abqaiq and Ras Tanura. Yanbu, on the western coast, is also a major target due to its refining and export infrastructure. The Saudi flagship NEOM project, close to the Jordanian and Israeli borders, which has never been attacked before, has been directly referenced in official Houthi messaging. This directly emanates from the Houthis’ growing confidence and extended ranges, and their desire to underscore that a renewed war would allow them to strike a new plethora of strategic assets within Saudi Arabia. A successful strike on the project would severely undermine investor confidence and damage the narrative of progress associated with the Saudi Vision 2030.

- Military installations in the southern border region, including King Khalid Air Base and Jazan and Abha airports, also represent significant targets. This is particularly given their proximity to the Yemeni border and the fact that the Houthis have targeted them with their shorter-range munitions, such as the Qasef 2-k UAVs. Additionally, major Red Sea ports and tourism infrastructure at Jeddah, Yanbu, and Duba hold substantial strategic and economic value for Riyadh, making them lucrative targets in a scenario of renewed armed conflict.

- The Houthis could further apply pressure by selectively targeting Saudi commercial shipping in the Red Sea, focusing on tankers, cargo vessels, and offshore infrastructure owned or operated by Saudi entities, effectively increasing maritime insurance and logistical costs.

Conclusion:

The Houthis have intensified their rhetoric against Saudi Arabia following the Israel-Hamas ceasefire and have stepped up efforts to mobilize additional forces in areas under their control. This reflects growing frustration with stalled negotiations over extending the truce and a desire to increase pressure on Riyadh to offer further concessions. While this could result in limited kinetic action aimed at pressuring Riyadh, the Houthi movement likely still retains an interest in avoiding a complete collapse of the ceasefire. This diminishes the prospects for a large-scale renewal of cross-border attacks against the kingdom in the short term. However, in a scenario of a complete breakdown of the truce, the Houthis would be better positioned to strike a more robust and expansive bank of targets within Saudi Arabia (and the UAE), due to qualitative leaps in Houthi capabilities over the past few years.

Recommendations:

Saudi Arabia:

- Travel to Saudi Arabia and the UAE may continue while adhering to security precautions and cultural norms.

- Avoid travel to areas along the Saudi-Yemen border due to the elevated risk of cross-border attacks.

- Monitor regional developments related to the Yemen truce negotiations and Houthi rhetoric vis-a-vis Saudi Arabia and the UAE, and conduct more frequent risk assessments for business travel to and operations in Saudi Arabia.

- Establish/refresh business contingency plans (BCPs) for operations in Saudi Arabia and the UAE, with an emphasis on a scenario of an escalation between the Houthis and Saudi Arabia/the UAE.

- Contact us at [email protected] for tailored, timely risk assessments and/or tactical monitoring services.

- MAX Security has strong on-ground capabilities in Saudi Arabia and the UAE, including secure transportation, provision of safe havens, and contingency consultation and planning. Contact us at [email protected] or +44 20-3540-0434.

Yemen:

Continue to avoid travel to Yemen at the current juncture, especially to Houthi-controlled territories, amid elevated risks posed to foreign nationals.

Executive Summary:

- In recent weeks, Houthi officials have significantly intensified their rhetoric against Saudi Arabia, aiming to pressure Riyadh into accepting the 2023 UN-brokered roadmap.

- This was accompanied by on-ground developments, including large-scale mobilization of tribal forces and military drills near the Saudi-Yemeni border, signaling potential Houthi readiness to apply additional pressure.

- At the current juncture, both Saudi Arabia and the Houthis likely retain an interest in avoiding a renewed cross-border conflict, reducing the prospects for large-scale Houthi aerial attacks against Saudi strategic infrastructures.

- Nevertheless, there remains a possibility that talks would break down or that the Houthis would resort to cross-border attacks against Saudi soil to improve their leverage.

- Monitor regional developments and conduct more frequent risk assessments for business travel to and operations at key Saudi infrastructure.

Current Situation:

Political statements:

- On October 29, the official spokesperson of the Houthis, Mohamed Abdulsalam, met with UN Special Envoy Hans Grundberg to discuss reactivating and enforcing the UN-backed Yemen roadmap. The plan, brokered by Grundberg in December 2023, outlines commitments to a nationwide ceasefire and a series of economic measures.

- Between October 27 and November 23, the UN Special Envoy to Yemen, Hans Grundberg, visited Oman and Bahrain as part of the UN’s efforts to engage the parties to the Yemeni conflict and advance negotiations toward a political settlement.

- Grundberg stated that the regional context provides an opportunity to revive momentum toward de-escalation and bolstering dialogue in support of the peace track in Yemen. He called on “all parties to exercise restraint, engage in dialogue, and take practical steps to alleviate the sufferings of Yemenis.” Grundberg also met with the Houthis’ Chief Negotiator to discuss the need for a conducive environment for a meaningful and inclusive political process.

General Developments:

- On November 9, the Sana’a-based Houthi Ministry of Interior announced the arrest of an espionage network allegedly linked to a Saudi Arabia-based joint operations room run by the CIA, Israel’s Mossad, and the Saudi intelligence.

- The defendants have been charged with “espionage activities involving foreign countries hostile to the Houthis, including the US, the UK, and Israel.” Specific charges against the detainees include assisting the Saudi-led coalition in its war against the group, collecting military and political intelligence on senior Houthi officials, and geolocating military infrastructure within Houthi-held areas. On November 9, a trial was initiated against the defendants.

- On November 22, a Houthi-controlled court sentenced 17 Yemenis to death by firing squad, issued ten-year prison terms to two others, and acquitted one. Prosecutors accused the defendants of spying for Saudi, UK, US, and Israeli intelligence services between 2024 and 2025.

Assessments & Forecast:

Key hurdles derailing the UN-sponsored peace framework

- Since late October, the Houthis have intensified pressure on Saudi Arabia to meet what they describe as its financial commitments under the Oman-mediated roadmap. Initially launched in 2022 after the UN-brokered truce between the Presidential Command Council (PCC) and the Houthis, the roadmap was finalized in December 2023 following extensive consultations involving Oman, the UN Special Envoy, Saudi Arabia, and the Houthis. It envisioned a permanent ceasefire, mechanisms for allocating oil revenues to fund public-sector salaries, and a broader framework for a lasting political settlement.

- For Saudi Arabia, the roadmap was an opportunity to draw down its costly military involvement while securing Houthi commitments to cease cross-border attacks, which are essential to its national economic transformation. This also meant enabling direct negotiations between the Houthis and the PCC. Although neither side formally signed the agreement, both endorsed it in principle as a pathway to permanent conflict resolution.

- However, the roadmap talks stalled under a series of compounding crises and structural contradictions. The roadmap lacked binding sequencing and enforcement mechanisms, allowing each party to interpret obligations through its own interests. Salary payments became an early flashpoint of tensions. The Houthis expected roughly 100 million USD per month under the roadmap. The agreement also relied on 2014 payroll lists, even though the Houthis had since replaced many civil servants with loyalists and new military recruits. This meant that most personnel under Houthi control would not be paid, prompting the group to demand direct access to funds to maintain administrative and military financing. Riyadh and the PCC insisted on oversight to prevent funds from being diverted to military use, while the Houthis demanded direct transfers.

- At the same time, Houthi maritime attacks escalated sharply in the wake of the Gaza war, with the group abandoning de-escalation and intensifying Red Sea operations to position itself as a key element of the regional Iran-led “Axis of Resistance.” By March 2024, these actions led the PCC to suspend roadmap implementation. The situation worsened when the Trump administration redesignated the Houthis as a Foreign Terrorist Organization (FTO). Because many of the roadmap’s core provisions required Saudi Arabia to interface directly or indirectly with Houthi-controlled institutions, such as transferring revenue to Sana’a, funding civil and military salaries, coordinating customs revenues, and permitting the expansion of international flights or commercial shipping through Hodeidah and Sana’a airports, the FTO designation made these steps effectively illegal. Any Saudi government action that resulted in financial benefit to Houthi authorities would risk violating US terrorism financing laws, leaving Riyadh unable to carry out the economic and logistical commitments required to operationalize the roadmap.

- The roadmap also alienated key Yemeni actors, particularly the Southern Transitional Council (STC), which rejected the bilateral Saudi-Houthi framework and deepened fractures within the anti-Houthi camp. The STC made clear it would not accept any deal that sidesteps southern interests or reallocates oil and gas revenues without its consent. Leaked early drafts hinting at economic concessions to the Houthis at the South’s expense triggered a strong STC pushback.

- Subsequently, Saudi Arabia, under growing US pressure, reportedly pushed to revise the roadmap to include Houthi disarmament in line with UN Security Council (UNSC) Resolution 2216, which calls for restoring state authority and dismantling armed groups. While unconfirmed, this is plausible given Riyadh’s view that the Houthis were politically vulnerable at the time. It also aligned with the Trump administration’s “maximum pressure” campaign against Iran, reflecting efforts to weaken Tehran’s regional allies. However, the Houthis rejected such disarmament conditions. They framed the Saudi push for modified conditions as capitulation to US pressure and as evidence that the original roadmap was being unilaterally abandoned.

- Saudi policymakers likely eventually recognized that key elements of the roadmap created a paradox. Funding salaries in Houthi-held areas and allowing expanded port revenues at Hodeidah would bolster Houthi administrative capacity and long-term institutional resilience. With stable revenue streams, the Houthis could allocate greater resources to upgrading military capabilities, accelerating drone and missile development, and strengthening deterrence. This realization helps explain Riyadh’s hesitation to implement the roadmap as initially drafted and its move to condition progress on disarmament and security guarantees, seeking concessions that could offset the strategic advantages the Houthis stood to gain through economic consolidation.

Houthi motivations to pressure Riyadh to implement the roadmap

Economic factors

- The Houthis pushed more strongly for the roadmap following the Israel-Hamas ceasefire that was implemented in October. With that front de-escalating, the group shifted its rhetoric and pressure toward Saudi Arabia, openly declaring that the Gaza ceasefire “allows for bolstering the dialogue regarding the roadmap in Yemen.” Their urgency was reinforced by mounting economic strain, further worsened by the costs the Houthis incurred for their participation in the conflict. This mainly pertains to Israeli and US strikes in 2024-25 that degraded key revenue sources and infrastructures. The targeting of Ras Isa and Hodeidah ports disrupted major fuel profits and customs revenue, resulting in over one billion USD in damage. The extensive attacks on the Sanaa International Airport destroyed the national carrier’s fleet and disrupted flight operations, causing nearly 500 million USD in losses.

- The Trump administration’s FTO designation further restricted financial transactions, access to imports, and economic engagement in Houthi-held areas, contributing to a sharp decline in remittances to northern Yemen. Domestically, liquidity was further strained by the Aden-based Central Bank’s directive for banks in Houthi territory to relocate their headquarters to Aden. The Houthi decision in August to introduce new currency, publicly described as replacing damaged notes, was in reality an emergency response to severe liquidity shortages.

- Household conditions in Houthi-controlled areas of Yemen continue to deteriorate. Prices for staple goods remained high while wages stagnated, sharply eroding purchasing power. Only a small portion of the population receives regular salaries, and many families rely on casual labor, aid, or informal trade. An early 2024 report indicated that only around three percent of residents in Houthi-controlled areas were receiving consistent income, and additionally, more than 60 percent faced food insecurity. Securing public sector salary payments through the roadmap, therefore, became critical from the Houthi perspective, providing a means to stabilize governance in Sanaa, Hodeidah, and other key cities and reduce reliance on Iranian financial support.

Strengthening of the anti-Houthi bloc

- The Houthis also believe the anti-Houthi camp is strengthening. Saudi Arabia’s recent diplomatic and security initiatives have heightened the group’s threat perceptions. In September, Riyadh and the UK co-hosted a high-level conference attended by representatives from 35 states, who pledged millions in the first phase of a ten-year plan to strengthen the PCC-affiliated Coast Guard and counter smuggling and piracy in Yemeni waters.

- Operationally, PCC-aligned forces have also tightened maritime pressure. Multiple successful interceptions of Iranian weapon shipments in recent months, including the high-profile July 16 seizure, have constrained Houthi logistical flows and contributed to growing strategic concern in Sana’a regarding its freedom of action in the Red Sea.

- A related major pressure factor is the apparent expanding Emirati military buildup around Yemen, which the Houthis likely perceive as a strategic threat. This has been most evident through a network of new and upgraded airstrips across Zuqar Island, Socotra, and Mayun. Satellite imagery from October 2025 indicates that Zuqar Island hosts a nearly completed 2,000-meter airstrip (construction began in April 2025), a jetty, and associated logistics facilities. The site includes one operational aircraft hangar and another under construction, linked by a taxiway to two military emplacements. There are also new airstrips on Socotra’s Abd al-Kuri and Samhah, as well as Mayun Island, located at the Bab al-Mandab Strait.

- This buildup of infrastructure on Yemen’s Islands is likely to enhance oversight over movements in the Red Sea and the Yemeni coastline. It likely strengthens real-time monitoring of Houthi activity, supports the interception of Iranian weapons shipments, allows the launch of reconnaissance and limited strike missions against mainland targets, and facilitates surveillance of commercial shipping transiting the Red Sea.

- The UAE’s expanded infrastructure in Somalia’s Bosaso and Berbera extends the network into the Horn of Africa. For example, the Houthis viewed the UAE’s installation of a radar system in Bosaso as a direct escalation and, in April 2025, threatened to target this infrastructure.

Time-lapse of satellite imagery depicting the construction of airstrips surrounding Yemen (1 – Mayun, 2 – Abd al-Kuri, 3 – Samhah, 4 – Zuqar)

Signs of increasing tensions between the Houthis and Riyadh

- It is primarily the Houthis’ media campaigns and statements by senior political leaders that signal a noticeable escalation in tensions with Saudi Arabia. The Houthis have intensified efforts to cast Saudi Arabia as responsible for Yemen’s worsening economic conditions. The group’s senior leadership has escalated anti-Saudi rhetoric, signaling a psychological pressure campaign. Recent statements demonstrate a sharper tone and intent. For example, Politburo member Hezam al-Asad implicitly threatened attacks on Aramco and the Crown Prince’s flagship NEOM project. Meanwhile, in recent weeks, Houthi-affiliated media have been publishing reports of artillery and rocket shelling targeting Saada governorate border areas, describing these as “Saudi aggression.” These reports were prevalent in the past and have subsided over the past two years. Thus, their return signals a deliberate media campaign to revive narratives pertaining to an external Saudi threat.

- This renewed discourse, combined with accusations that Saudi Arabia is supporting Israel, suggests a deliberate reframing of bilateral tensions as part of a larger confrontation aligned with the regional “resistance” narrative. By positioning the escalation with Saudi Arabia within its anti-Israel posture, the group reinforces ideological cohesion and legitimacy. This approach was evident in Abdul Malik al-Houthi’s late September speech, in which he accused Saudi Arabia of protecting Israeli shipping in the Red Sea and warned that their efforts “will be in vain.”

- The subsequent Houthi claims of uncovering a Saudi-led espionage network, accompanied by released “confessions,” reinforce their narrative portraying Riyadh as aligned with Israel. Their messaging accuses Riyadh of aiding Israel through intelligence sharing and destabilizing Yemen. The Houthis tied these claims to the broader regional trajectory of normalization, arguing that Saudi Arabia’s potential entry into the Abraham Accords would create a new security framework involving the US and Israel at Yemen’s expense. By positioning normalization as proof of Saudi-Israeli/US collusion, they sought to elevate the bilateral conflict into part of the wider Iran-led Axis of Resistance struggle. This explains why Houthi social media accounts and broader messaging strenuously opposed the latest meeting between Crown Prince Mohammed bin Salman (MbS) and Donald Trump. They viewed this engagement as further evidence that Saudi Arabia is positioning itself within the US orbit under President Trump.

- Over the past several weeks, the Houthis have undertaken a coordinated campaign of military exercises, political signaling, and public mobilization to demonstrate combat readiness. In mid-November, multiple armed tribesmen in Ibb and Hajjah announced full preparedness for confrontation and reaffirmed loyalty to Houthi leader Abdulmalik al-Houthi. These declarations followed a national call for general mobilization on November 9, accompanied by large-scale armed rallies across Houthi-controlled areas, signaling alignment with the leadership. Concurrently, the Houthis have expanded the systematic militarization of Yemen’s university system, with thousands of students completing training in weapons handling, drone operations, and ideological instruction, thereby likely expanding reserve force capacity. Persistent rallies by armed tribesmen, ongoing recruitment, and field exercises, including operations in Saada, approximately five kilometers from the Saudi border, highlight these force buildup efforts.

- Taken together, these developments suggest that the Houthi leadership is at least preparing for a scenario in which political negotiations fail, and confrontation becomes increasingly probable. This was also supported by the UN Security Council (UNSC) Panel of Experts on Yemen, which stated in its latest report from October that “the Houthis’ armed forces increased their combat readiness and preparedness.”

Riyadh will prioritize pursuing negotiations in parallel to efforts to gain a qualitative military edge

- Saudi Arabia has demonstrated a clear preference for a negotiated settlement over military escalation in recent weeks, culminating in talks in Muscat in late October 2025. This approach is driven primarily by economic calculations, especially the need to safeguard the domestic transformation agenda under Vision 2030. Prolonged regional instability risks undermining investor confidence, which is critical to sustaining growth and financing major development projects. A renewed conflict would expose high-value infrastructure and economic centers to Houthi targeting, creating significant financial and reputational risk. Additionally, Saudi Arabia’s pursuit of major international ventures, including hosting the 2034 FIFA World Cup and bidding for other global events, provides further incentive to avoid large-scale escalation. Collectively, these factors reinforce Riyadh’s strategic interest in limiting regional volatility and prioritizing diplomatic avenues.

- Riyadh has therefore sought to compensate for its limited ability to independently reopen Sana’a airport and Hodeidah port by offering a set of discreet economic incentives to the Houthis. These reportedly include allowing Houthi authorities to secure legal aviation licenses from the PCC to establish a Houthi-operated airline. Saudi Arabia has reportedly reinstated long-standing financial grants for tribal leaders and select Houthi officials, instead of resuming salary payments to civil servants in Houthi-controlled areas, alleviating pressure on the group’s patronage networks. This approach delivers indirect economic benefits while avoiding the legal risks of directly funding an FTO-designated entity. Concurrently, Riyadh has reportedly pressed the PCC’s National Committee for the Regulation and Financing of Imports to allow Houthi-affiliated companies to engage in import activity, ease restrictions on their commercial operations, and facilitate increased trade flows through Hodeidah port. Collectively, these measures are meant to enable the Houthis to collect customs duties and taxes on significantly expanded import volumes without direct financial transfers from Saudi Arabia.

- This indicates that Riyadh remains willing to make economic concessions to prevent a collapse of the truce. Such calibrated concessions underscore Saudi Arabia’s assessment that the political and financial costs of renewed large-scale conflict outweigh the risks of limited economic accommodation. As a result, these measures are likely to continue serving as a stabilizing factor in the near term, reducing the immediate likelihood of a return to open conflict even as core political disputes remain unresolved.

- Meanwhile, Riyadh is working to bolster its long-term security relationships, with its alliance with the US at the core. The November US-Saudi Strategic Defense Agreement cemented this relationship by granting Riyadh Major Non-NATO Ally status, prioritizing defense cooperation, integrating intelligence sharing, and providing access to advanced systems, including F-35 fighter aircraft, Abrams tanks, and comprehensive air defense capabilities. Complementing this, the Strategic Mutual Defense Agreement with Pakistan highlights Riyadh’s push to expand strategic defense pacts with allies. Other initiatives include regional military coordination in exercises like Red Wave 8, which integrate naval, air, and coastal forces across multiple Gulf states.

- Collectively, these measures furnish Saudi Arabia with more robust security guarantees and measures to gain a qualitative military edge in the long term. This further incentivizes Riyadh to pursue a de-escalatory stance in the short term.

Forecasting Houthi pressure tactics against Saudi Arabia in the near term

- FORECAST: The likelihood of the Houthis initiating a full-scale offensive against Saudi Arabia remains relatively low at present, given ongoing diplomatic efforts and indications that the Houthis still retain an overall interest in maintaining calm. To some extent, this Houthi interest is likely influenced by the weakened position of Iran’s Axis of Resistance camp in the wake of its 12-day war with Israel. In this context, Iran is likely partially turning its attention inwards, dedicating extensive efforts to replenish its own drone and ballistic missile arsenal in anticipation and concern of future rounds of hostilities with Israel. This likely decreases to some extent Tehran’s ability to extend material and financial support to the Houthis, likely bolstering the Houthis’ interest in preserving their resources for future rounds of hostilities with Israel.

- Under these circumstances, Houthi dissatisfaction and a desire to increasingly pressure Riyadh are more likely to manifest in gradual, limited escalatory actions designed to give the Saudi leadership time to cave in to Houthi demands without risking a full-scale flare-up of hostilities. In this context, limited cross-border attacks along the Saudi-Yemen frontier remain a possibility as part of Houthi efforts to increase their leverage.

- FORECAST: At the same time, Houthi rhetoric against Saudi Arabia is expected to remain a primary coercive tool, serving as a visible indicator of dissatisfaction with the progress of negotiations. Senior leaders continue to issue explicit threats, often invoking historical reminders of high-impact strikes to reinforce credibility.

- FORECAST: The Houthis will also continue to prioritize reinforcing military positions against anti-Houthi formations. As a result, force deployments, logistical buildup, and mobilization of fighters will continue over the coming months, increasing tensions along frontlines overall.

Assessing Houthi capabilities, and target banks in case of renewed Saudi-Houthi conflict

- Over the past two years, the Houthis have crystallized their transition from an actor with a limited outreach within the context of the Yemen civil war to a strategic, regional actor employing force at ranges exceeding 2,000 km in response to regional crises. Their drone and missile attacks against Israel constituted the longest-range sustained offensive campaign by a non-state force, involving over 200 missiles and drones, several of which have penetrated Israeli air and missile defenses.

- These qualitative leaps, manifested in the Houthis’ continued improvement in UAV and missile technology with Iranian support, enable them to exploit vulnerabilities and impose costs on regional state actors, including those with advanced aerial defenses. This increases the Houthis’ deterrence and the overall threat they pose to Saudi Arabia and the UAE should major hostilities break out, with Houthi operational ranges covering the entirety of the Gulf region.

- In addition, their maritime attack campaign in the Red Sea and Gulf of Aden was the most effective maritime disruption effort ever conducted by a non-state actor, with more than 300 attacks by 2025 and over 100 commercial vessels targeted, largely through relatively low-cost drones and missiles. At the same time, their ability to intercept and shoot down 14 MQ-9 Reaper drones further highlights improvements in air defenses.

- Despite more than 1,200 US airstrikes between March and May, the Houthis retained operational continuity, rebuilt critical infrastructure, and continued launching drones, ballistic missiles, and surface-to-air munitions, reflecting the resilience of their distributed manufacturing, underground storage systems, and supply chains.

- The movement fields a diversified and integrated strike arsenal that includes long-range UAVs and a growing inventory of ballistic and cruise missiles. By late 2025, the group is reportedly assessed to retain more than 200 ballistic missiles, 100 cruise missiles, substantial UAV inventories, anti-ship weapons, and air defense systems, which could facilitate months of high-tempo operations.

- A complete breakdown in negotiations could prompt Houthi strikes against strategic Saudi sites, including in Riyadh, as well as key economic assets across the kingdom, such as the Eastern Province’s energy facilities of Abqaiq and Ras Tanura. Yanbu, on the western coast, is also a major target due to its refining and export infrastructure. The Saudi flagship NEOM project, close to the Jordanian and Israeli borders, which has never been attacked before, has been directly referenced in official Houthi messaging. This directly emanates from the Houthis’ growing confidence and extended ranges, and their desire to underscore that a renewed war would allow them to strike a new plethora of strategic assets within Saudi Arabia. A successful strike on the project would severely undermine investor confidence and damage the narrative of progress associated with the Saudi Vision 2030.

- Military installations in the southern border region, including King Khalid Air Base and Jazan and Abha airports, also represent significant targets. This is particularly given their proximity to the Yemeni border and the fact that the Houthis have targeted them with their shorter-range munitions, such as the Qasef 2-k UAVs. Additionally, major Red Sea ports and tourism infrastructure at Jeddah, Yanbu, and Duba hold substantial strategic and economic value for Riyadh, making them lucrative targets in a scenario of renewed armed conflict.

- The Houthis could further apply pressure by selectively targeting Saudi commercial shipping in the Red Sea, focusing on tankers, cargo vessels, and offshore infrastructure owned or operated by Saudi entities, effectively increasing maritime insurance and logistical costs.

Conclusion:

The Houthis have intensified their rhetoric against Saudi Arabia following the Israel-Hamas ceasefire and have stepped up efforts to mobilize additional forces in areas under their control. This reflects growing frustration with stalled negotiations over extending the truce and a desire to increase pressure on Riyadh to offer further concessions. While this could result in limited kinetic action aimed at pressuring Riyadh, the Houthi movement likely still retains an interest in avoiding a complete collapse of the ceasefire. This diminishes the prospects for a large-scale renewal of cross-border attacks against the kingdom in the short term. However, in a scenario of a complete breakdown of the truce, the Houthis would be better positioned to strike a more robust and expansive bank of targets within Saudi Arabia (and the UAE), due to qualitative leaps in Houthi capabilities over the past few years.

Recommendations:

Saudi Arabia:

- Travel to Saudi Arabia and the UAE may continue while adhering to security precautions and cultural norms.

- Avoid travel to areas along the Saudi-Yemen border due to the elevated risk of cross-border attacks.

- Monitor regional developments related to the Yemen truce negotiations and Houthi rhetoric vis-a-vis Saudi Arabia and the UAE, and conduct more frequent risk assessments for business travel to and operations in Saudi Arabia.

- Establish/refresh business contingency plans (BCPs) for operations in Saudi Arabia and the UAE, with an emphasis on a scenario of an escalation between the Houthis and Saudi Arabia/the UAE.

- Contact us at [email protected] for tailored, timely risk assessments and/or tactical monitoring services.

- MAX Security has strong on-ground capabilities in Saudi Arabia and the UAE, including secure transportation, provision of safe havens, and contingency consultation and planning. Contact us at [email protected] or +44 20-3540-0434.

Yemen:

Continue to avoid travel to Yemen at the current juncture, especially to Houthi-controlled territories, amid elevated risks posed to foreign nationals.